- Categories

Surplus BioPharma

- Find Auctions

- Locations

- Closing Today

- New Listings

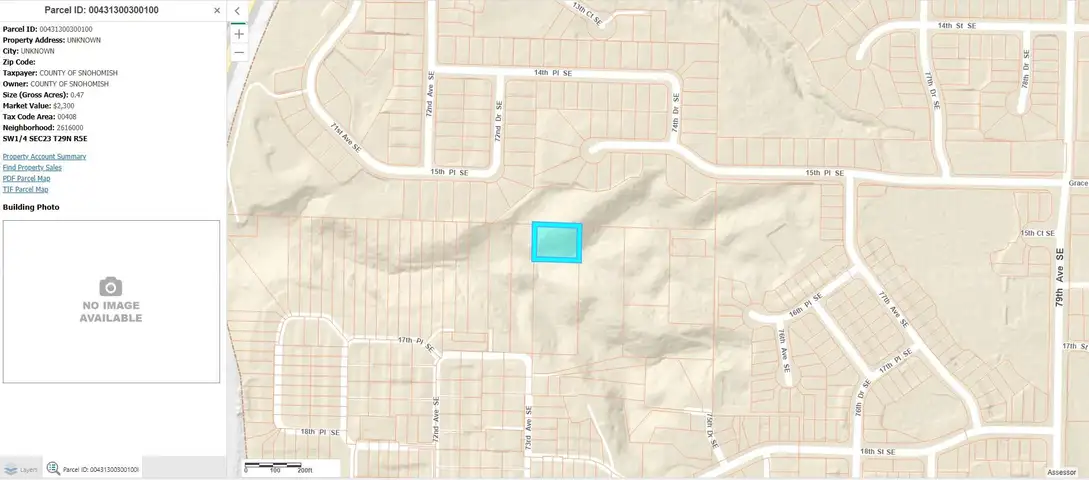

0.47 Acres Vacant Land in Lake Stevens, WA

5d20h(Jul 21, 2025 03:00 PM UTC)

$100.00 USD

Bid IncrementOnline Auction

Location:

Everett, Washington, USASubject to an auto-extension of the auction end time.

Possible Bad Bid

Is this correct?

If this is correct, to continue select "Accept Bid."

If this is incorrect or you want to submit as a Max Auto Bid, select "Reject Bid."

WATCHERS: 49 |VISITORS: 363

Taxes

To be added at payment

Buyer's Premium

12.5%

High Bidder

mo*****

Seller

Account Type

Government

Seller's Terms & Conditions

Seller's Other Items

Description

Lot#

26123-3

Condition

Used/See Description

SEC 23 TWP 29 RNG 5 QTR SW - EAST EVERETT BLK 003 D-00 - LOTS 1-2-3 TGW TH PTN VAC 73RD AVE SE & 16TH ST & ALLEY ADJ THRTO PER SCC #06-2-10757-6 REC AFN 200612190547

Buyers discretion to acquire and pay for title report/policy if desired.

Buyer will receive a Treasurer's Deed.

Winning bid will include recording fees, transfer fees, taxes etc.

You may utilize the below link to search county information by the listed parcel number.

Snohomish County Property Tax Portal

Seller Information

Inspection

Payment

PAYMENT

If you are the winning bidder, you will facilitate payment by referring to the My Bids section of your account.Note:

1. Payment is due within 5 (five) business days of auction closure.

2. Any invoice $5,000 or above requires payment via wire transfer.

3. Depending on your history with GovDeals, you may be limited to the number of auctions/transactions that you can participate in simultaneously AND/OR the dollar amount that you can pay via credit card, debit card or PayPal. For additional insight, please visit the Probation FAQ.

SALES TAX

When applicable, sales tax is calculated based upon the auction’s advertised location.If you are seeking sales tax exemption, you must complete Liquidity Services’ tax exemption form(s). We recommend doing this prior to the auction’s closure or before making payment. To do so, please visit Liquidity Services' Tax Exemption Submission Tool.

Removal

***SHIPPING IS NOT AVAILABLE***

The buyer is responsible for all aspects of pick-up / removal, including but not limited to packing, loading, transportation and exporting. Note: Shipping is NOT available.

Removal is by appointment only. All items must be picked-up / removed within 10 (ten) business days from auction closure, unless otherwise stated in the asset description. If any item(s) is not removed within the allotted timeframe, the item(s) may be declared abandoned.

At the time of pick-up / removal, you will be required to present the seller with a copy of your Buyer’s Certificate and/or bill of sale, and potentially other documentation (e.g., copy of driver's license, Authorization of Release, etc). When making a removal appointment, please confirm with the seller what is needed to release the item(s).

Removal and Transportation Options

Discover unbeatable nationwide transporters from our preferred shippers. Explore our curated list of qualified third-party shipping vendors to revolutionize your shipping experience.

Special Instructions

A Treasurer’s Deed will be issued upon receipt of full payment and vesting instructions from the auction website within thirty (30) days from receipt. Every parcel is sold “where is” and “as is” without any representation or warranty, expressed or implied. No representation is made or implied as to whether the parcel meets zoning or building requirements. Purchaser will take responsibility for any hazardous material on site of purchased parcel. Purchaser will take responsibility for any wetland protection regulations on said property.

The sale is subject to any special assessment liens of other taxing districts, competing Federal liens, whether known or unknown, and easements, covenants, and restrictions of record, if any.

Additional Information

First time bidding? Please review our Terms and Conditions.

For further assistance please review our Frequently Asked Questions.