- Categories

Surplus BioPharma

- Find Auctions

- Locations

- Closing Today

- New Listings

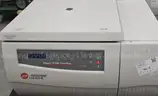

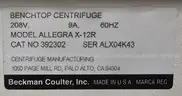

Lot of 3 Centrifuges: Beckman Coulter X-12R & X-15R (401-9)

6d(Jul 15, 2025 11:00 PM UTC)

$2.00 USD

Bid IncrementOnline Auction

Location:

Seattle, Washington, USASubject to an auto-extension of the auction end time.

Possible Bad Bid

Is this correct?

If this is correct, to continue select "Accept Bid."

If this is incorrect or you want to submit as a Max Auto Bid, select "Reject Bid."

Description

Make/Brand

Beckman Coulter

Model

X-12R, X-15R

Lot#

6794-6317

Condition

Used/See Description

Inventory ID

401-9

Equipment is sold as-is, where-is. This equipment is untested. Only items shown in photos are included with the equipment. Unless otherwise noted, moving carts and racks are not included in the auction.

This equipment is located on UW's Seattle campus: Plant Services Building 4515 25th Ave. NE Seattle, WA 98105.

You can inspect this equipment by scheduling an appointment. Please visit https://bit.ly/UWSurplusAuction or email: surplus@uw.edu to schedule an inspection.

PLEASE NOTE: UW Surplus is *not* set up to offer packing or shipping. The Buyer will make all arrangements and perform all work necessary, including packing, loading and transportation of the property. All third-party pick-ups need to be communicated to UW Surplus before release of items.

Click the UW Surplus logo below to see our other auction listings.

Seller Information

Seller:

Item Location:

Inspection

Payment

PAYMENT

If you are the winning bidder, you will facilitate payment by referring to the My Bids section of your account.

Note:

1. Payment is due within 5 (five) business days of auction closure.

2. Any invoice $5,000 or above requires payment via wire transfer.

3. Depending on your history with GovDeals, you may be limited to the number of auctions/transactions that you can participate in simultaneously AND/OR the dollar amount that you can pay via credit card, debit card or PayPal. For additional insight, please visit the Probation FAQ.

SALES TAX: Non Vehicles

When applicable, sales tax is calculated based upon the auction's advertised location.

If you are seeking sales tax exemption, you must complete Liquidity Services' tax exemption form(s). We recommend doing this prior to the auction's closure or before making payment. To do so, please visit Liquidity Services' Tax Exemption Submission Tool.

SALES TAX: Vehicles

Exempt Bidders:

If you are seeking sales tax exemption, you must complete Liquidity Services’ tax exemption form(s). We recommend doing this prior to the auction’s closure or before making payment. To do so, please visit Liquidity Services' Tax Exemption Submission Tool.

In State Bidders- Non Exempt:

Sales Tax will be applied to all sales.

Out of State Bidders- Non Exempt:

If you are seeking sales tax removal, you must complete Liquidity Services' tax exemption form(s). This must be completed before making payment. To do so, please visit Liquidity Services' Tax Exemption Submission Tool for Out of State Vehicle Buyers. You will be provided two forms to bring to Seller that will be signed upon removal.

Removal

All UW Surplus merchandise pickups will be conducted by appointment only. After payment has been completed, Buyers will receive instruction on how to schedule an appointment. UW Surplus Auction hours 8:30-3:30 Pacific time zone. We are closed weekends and holidays. All items must be removed within ten (10) business days from the time and date of issuance of the Buyer's Certificate.

The Buyer will make all arrangements and perform all work necessary, including packing, loading and transportation of the property. No Assistance will be provided. A daily storage fee of $10.00 may be charged for any item not removed within the 10 business days allowed and stated on the Buyer's Certificate. When you arrive onsite, please call us at 206-685-1573 and let us know you are here. Surplus staff will ask questions related to your purchase and direct you where to park.

Merchandise purchased will be released only to the Buyer or the Buyer's authorized representative. Buyer is responsible for the removal of all their purchases from the loading area. Buyer will make all arrangements and perform all work necessary, including packing, loading and transportation of the property. No assistance will be provided. Exceptions may be made for large items requiring forklift assistance, but will be determined on a case-by-case basis upon a written request emailed to surplus@uw.edu.

Before release will be made to the Buyer’s authorized representative, the Buyer must send email notification to UW Surplus at surplus@uw.edu stating the name of the of the Buyer’s authorized representative. UW Surplus requests a copy of the Bill of Lading [BOL] for its records if the Buyer’s authorized representative will be a freight company. Buyer is responsible for all packing, shipping costs, and arrangements. Buyer's name must be listed as shipper on all shipping documentation.

Late arrivals: Please plan ahead to arrive for your appointment on time. This is the best way to help us keep on schedule for you and all other customers. We also understand that there may be unavoidable delays. If you arrive late, we will make every effort to assist you, however, your appointment may need to be rescheduled.

Removal and Transportation Options

Discover unbeatable nationwide transporters from our preferred shippers. Explore our curated list of qualified third-party shipping vendors to revolutionize your shipping experience.

Special Instructions

Guaranty Waiver. All property is offered for sale 'AS IS, WHERE IS.' University of Washington Surplus Property, WA makes no warranty, guaranty or representation of any kind, expressed or implied, as to the merchantability or fitness for any purpose of the property offered for sale. Please note that upon removal of the property, all sales are final.

Description Warranty. Seller warrants to the Buyer that the property offered for sale will conform to its description. Any claim for misdescription must be made prior to removal of the property. If Seller confirms that the property does not conform to the description, Seller will keep the property and refund any money paid. The liability of the seller shall not exceed the actual purchase price of the property.

University of Washington Surplus Property, WA reserves the right to reject any and all bids and to withdraw from sale any of the items listed.

Additional Information

First time bidding? Please review our Terms and Conditions.

For further assistance please review our Frequently Asked Questions.